For decades, financial professionals have been bogged down by the tedious and time-consuming general ledger reconciliation process. Month-end closings, manual audits, and the constant back-and-forth between spreadsheets have been the reality for accountants and finance teams worldwide.

But that’s all about to change.

A groundbreaking shift is underway in Enterprise Resource Planning (ERP), and it’s being led by artificial intelligence. Microsoft Dynamics 365 Finance is at the forefront of this transformation, embedding AI-driven automation to streamline financial processes and reduce manual reconciliation efforts. This transformation is not just an upgrade—it’s a complete reinvention of how financial systems operate.

Imagine having an intern—a highly intelligent, never-tired, ever-learning AI intern—who handles the most mundane parts of your job, ensuring accuracy, speed, and efficiency like never before. That’s exactly what’s happening with the next evolution of automatic general ledger reconciliation. And it’s going to be a game-changer for finance teams everywhere.

The End of Tedious Month-End Reconciliation?

For years, finance teams have relied on a largely manual or semi-automated process to reconcile accounts—pulling transaction data, matching records, identifying discrepancies, and resolving issues. It’s slow, error-prone, and takes up valuable time that could be spent on more strategic work.

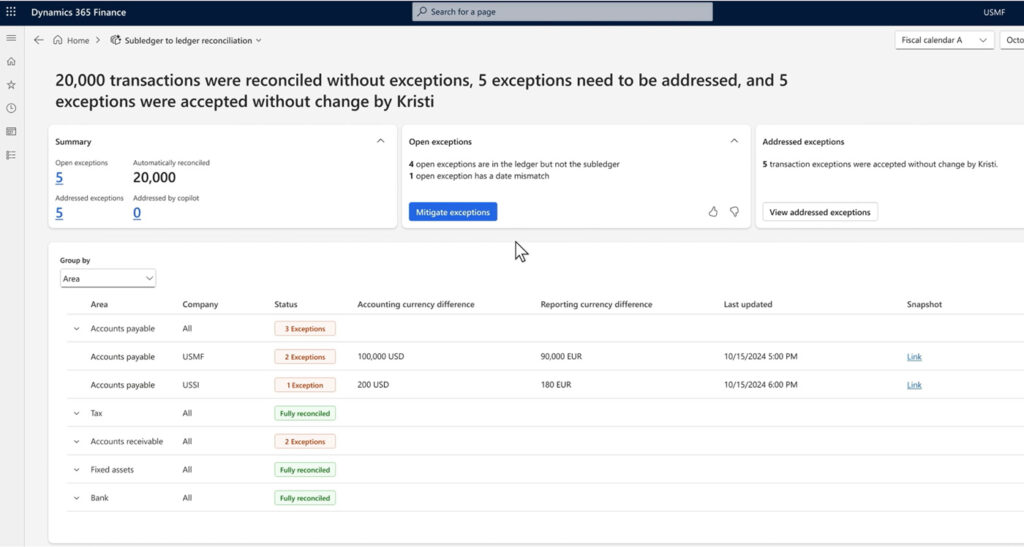

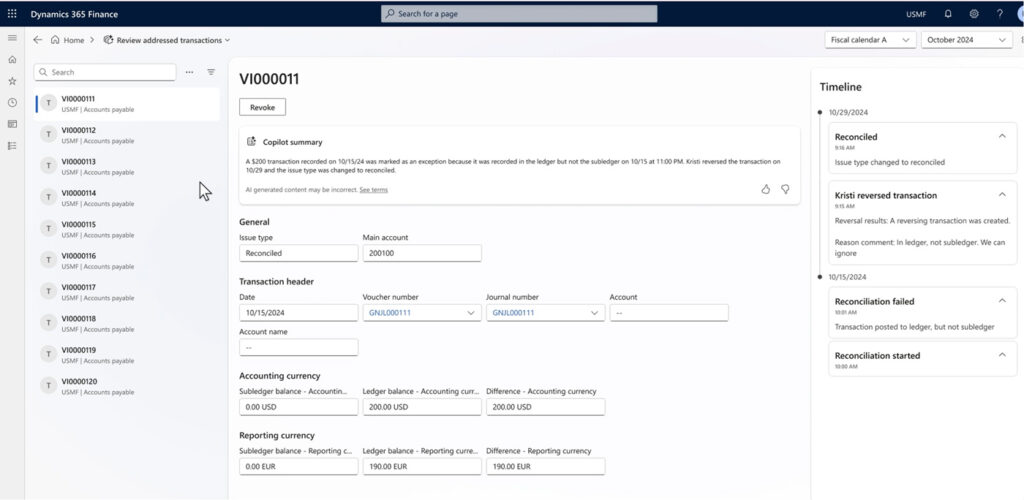

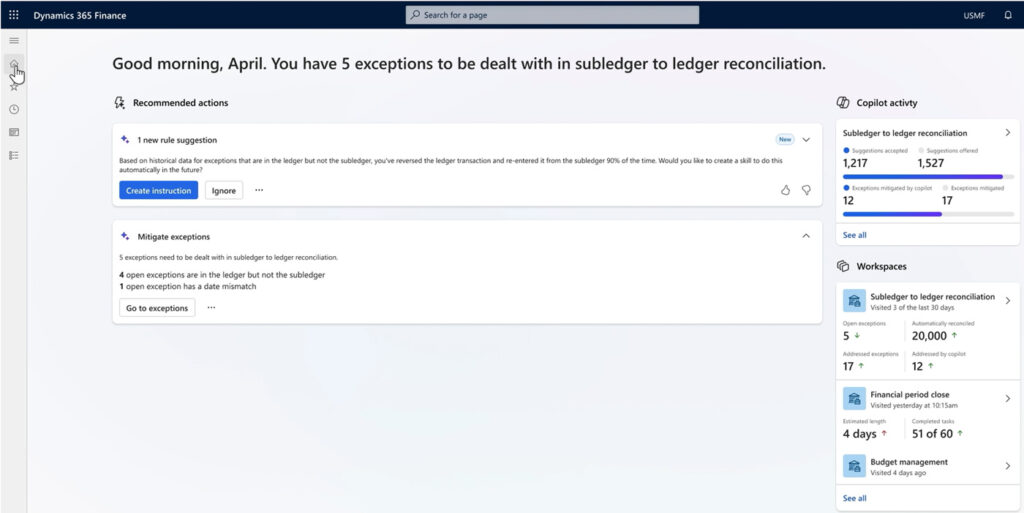

But with AI-powered reconciliation, everything changes. Instead of waiting until the end of the month to catch and correct errors, the Account Reconciliation Agent in Dynamics 365 Finance continuously monitors and reconciles transactions in real time. This means fewer errors, faster closings, and—most importantly—less time wasted on repetitive, low-value tasks.

This shift marks the beginning of a transformation in financial applications, moving towards an agent-driven model. Instead of interacting with traditional financial software through screens and manual entry, finance teams will supervise AI agents that handle reconciliation automatically. These agents work in the background, ensuring that financial data stays up to date without requiring constant human intervention.

To see the Account Reconciliation Agent in action, watch this video from Microsoft: https://www.youtube.com/watch?v=e_5hguWGqRk

The Future of Business Applications: From Screens to AI Agents

The shift we are seeing in financial reconciliation is just the first step in a much bigger evolution—one that will redefine business applications as we know them. Traditionally, business applications have relied on structured interfaces where users manually enter data, select options, and click buttons to process transactions. But that model is rapidly becoming obsolete.

Satya Nadella, CEO of Microsoft, recently described this transformation:

“The human supervisor won’t need a screen anymore… They’ll be looking over the shoulder of AI agents, handling only the exceptions.”

Instead of navigating through complex ERP systems, employees will orchestrate AI-driven workflows, focusing only on decision-making rather than data entry. Leveraging Microsoft Dynamics 365 Finance’s intelligent Account Reconciliation Agent, finance professionals can move beyond manual financial processes and instead supervise AI-driven agents that continuously analyze, reconcile, and report transactions in real time. This represents a paradigm shift—business applications will no longer be tools we actively engage with. They will be autonomous systems that work for us.

A Digital Intern for Every Finance Professional

To put it simply: Think of these AI-powered agents as interns. Every finance professional now has an AI intern assigned to them—someone who takes on the repetitive, error-prone parts of the job. These AI interns aren’t replacing people; they’re here to help.

They’ll learn from their mentors (real employees), improving over time and handling increasingly complex tasks with greater accuracy. At first, they’ll make mistakes—just like any new hire would. But as they receive guidance, they’ll refine their processes and eventually work almost entirely unsupervised.

This is not about replacing jobs—it’s about enhancing them. By shifting time-consuming reconciliation tasks to AI-driven agents, finance professionals can focus on higher-value strategic work, such as financial planning, forecasting, and advisory roles.

The Future of Third-Party Reconciliation Tools

For years, many companies have relied on third-party reconciliation software to manage financial close processes. These tools helped automate certain aspects of reconciliation but often required exporting data out of the ERP, processing it separately, and then feeding it back into the system.

Now, AI-powered reconciliation removes that extra step by embedding these capabilities directly within the ERP. With Dynamics 365 Finance, organizations no longer need to rely on third-party reconciliation tools. As these AI agents continuously analyze and reconcile financial data as transactions occur, organizations no longer have to wait and perform reconciliation in batches at the end of the month.

This real-time approach compresses the month-end close process—and in some cases, eliminates it entirely as a standalone function.

For organizations evaluating automated reconciliation solutions, consider these key elements:

- Transparency: The AI must provide a clear audit trail, so finance teams can verify and correct actions when necessary.

- Control: Humans should always remain in control, with the ability to override AI-driven decisions.

- Learning Capabilities: The AI should improve over time, learning from corrections to become increasingly accurate.

Companies that embrace this shift will reduce their reliance on external reconciliation tools and streamline operations, improving both efficiency and accuracy in financial reporting.

When Will This Technology Be Available?

The exciting news is that this isn’t a concept for the distant future—AI-powered general ledger reconciliation is here now.

A major release in Dynamics 365 Finance is scheduled for February 2025, bringing the first generation of the Account Reconciliation Agent into this powerful ERP system. This is not a vague “coming soon” promise—it’s a tangible reality that will start transforming finance teams within weeks.

Of course, this is just the beginning. Future iterations will make these AI agents even smarter, allowing them to handle more complex reconciliation tasks, flag anomalies with greater precision, and ultimately eliminate many of the pain points that have plagued financial reconciliation for decades.

The early adopters of this technology will gain a massive competitive advantage, streamlining their operations before their competitors catch up. Here’s a sneak preview of the agents in action.

The Beginning of an AI-Led Financial Revolution

We are standing on the threshold of a massive transformation in finance. AI-powered general ledger reconciliation is just the first step in a larger movement toward fully autonomous business applications. With Dynamics 365 Finance & Supply Chain Management, Microsoft is leading this shift, providing AI-driven reconciliation tools that allow finance professionals to focus on strategic decision-making rather than manual data entry.

The days of manually matching transactions, waiting until the end of the month to resolve errors, and relying on external reconciliation tools are coming to an end.

Finance professionals who embrace this shift will gain a competitive edge—not because they’re being replaced, but because they’ll be freed from tedious tasks and empowered to focus on higher-value financial strategy.

As I see it, we’re entering a world where finance teams will no longer manually input and validate transactions. Instead, we’ll be guiding AI agents, reviewing their work, and handling only the exceptions that require human judgment. The future isn’t five years away. It’s here. It’s starting now. And for finance teams everywhere, it’s about to change everything.

You don’t have to navigate this transformation alone. If your team needs guidance or wants to explore how AI-powered reconciliation can benefit your organization, we’re here to help. Reach out to us at [email protected].

If you found this article helpful, check out our recent webinar: Top 10 Game-Changing Features in Dynamics 365 Finance: Versions 41 and 42 where we discuss automated general ledger reconciliation and a few other features that are coming your way.

By David Schwantes, Pre-Sales Solution Architect D365 Finance, SCM, Commerce at Arctic IT